AI Possibilities Case Studies

The following are case studies that can help us conceptualize AI in the real world.

Financial Forecasting

In this case study, we will look at how artificial intelligence has been utilized in governmental financial services. National banks, such as the Federal Reserve of United States and the European Central bank of the European Union, have started to explore how Artificial Intelligence can be used for data mining and economic forecast prediction.

There are many uses of AI for improving financial institutions, each with potential benefits and risks. Most financial institutions weigh the benefits and risks carefully before implementation.

For instance, if a financial institution takes a high-risk prediction seriously, such as predicting a financial crisis or a large recession, then it would have huge impact on a bank’s policy and allows the bank to act early. However, many financial institutions are hesitant to take action based on artificial intelligence predictions because the prediction is for a high-risk situation. If the prediction is not accurate then there can be severe consequences. Additionally, data on rare events such as financial crises are not abundant, so researchers worry that there is not enough data to train accurate models (Nelson 2023).

Many banks prefer to pilot AI for low-risk, repeated predictions, in which the events are common and there is a lot of data to train the model on.

Let’s look at a few examples that illustrate the potential benefits and risks of artificial intelligence for improving financial institutions.

Categorizing Businesses

An important task in analysis of economic data is to classify business by institutional sector. For instance, given 10 million legal entities in the European Union, they need to be classified by financial sector to conduct downstream analysis. In the past, classifying legal entities was curated by expert knowledge (Moufakkir 2023).

Text-based analysis and machine learning classifiers, which are all considered AI models, help reduce this manual curation time. An AI model would extract important keywords and classify into an appropriate financial sector, such as “non-profits”, “small business”, or “government”. This would be a low-risk use of AI, as one could easily validate the result to the true financial sector.

Incorporating new predictors for forecasting

Banks are considering expanding upon existing traditional economic models to bring in a wider data sources, such as pulling in social media feeds as an indicator of public sentiment. The National bank of France has started to use social media information to estimate the public perception of inflation. The Malaysian national bank has started to incorporate new articles into its financial model of gross domestic product estimation. However, the use of these new data sources may may raise questions about government oversight of social media and public domain information (OMFIF 2023).

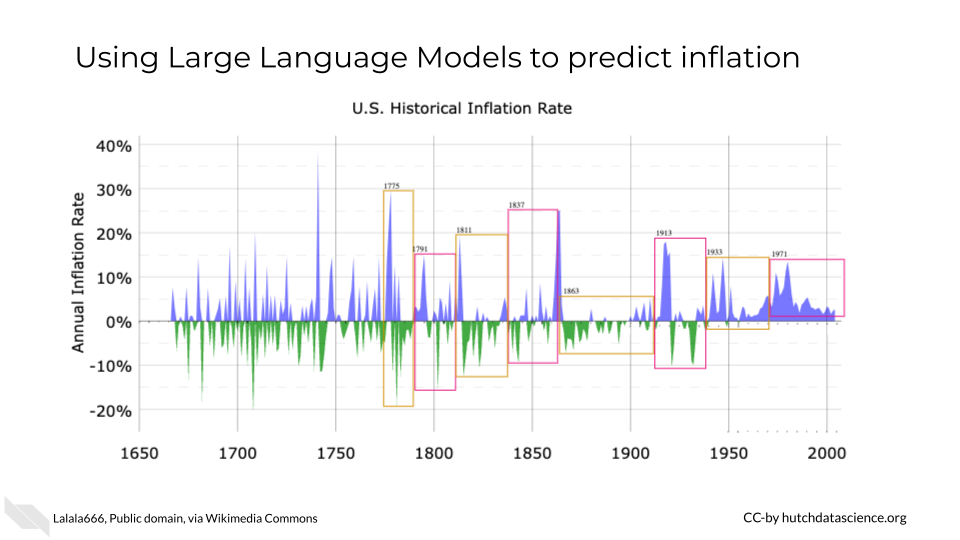

Using Large Language Models to predict inflation

The US Federal Reserve has researched the idea of using pre-trained large language models from Google to make inflation predictions. Usually, inflation is predicted from the Survey of Professional Forecasters, which pools forecasts from a range of financial forecasts and experts. When compared to the true inflation rate, the researchers found that the large language models performed slightly better than the Survey of Professional Forecasters (Federal Reserve Bank of St. Louis 2023).

A concern of using pre-trained large language models is that the data sources used for model training are not known, so the financial institution may be using data that is not in line with its policy. Also, a potential risk of using large language models that perform similarly is the convergence of predictions. If large language models make very similar predictions, banks would act similarly and make similar policies, which may lead to financial instability (OMFIF 2023).

Disclaimer: The thoughts and ideas presented in this course are not to be substituted for legal or ethical advice and are only meant to give you a starting point for gathering information about AI policy and regulations to consider.